Planned Giving is a great way to support Taproot Theatre and to make a lasting impact on the theatre you love while planning for the future. When you make a charitable gift through your estate, you allow Taproot Theatre to continue telling hope-filled stories from the stage for years to come. Gifts of this kind provide you the ability to maintain control of your assets during your lifetime, while also providing tax benefits for yourself and your heirs.

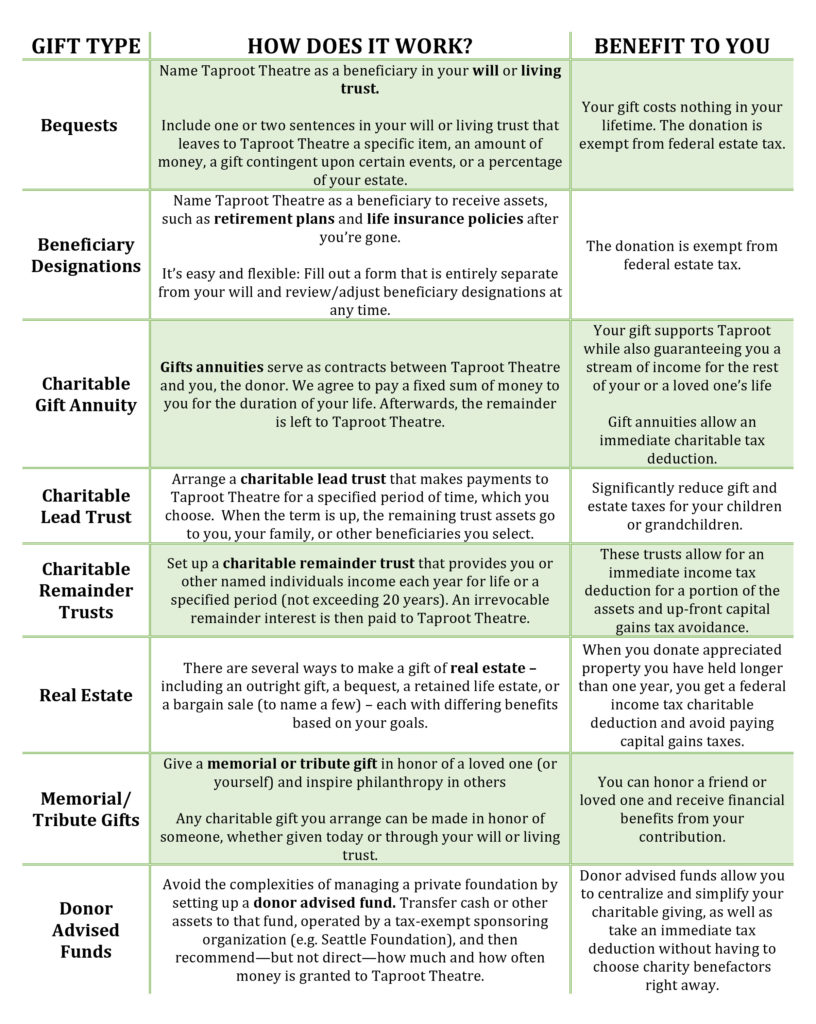

See the giving options below to help determine the best option for you! Click the below image to enlarge.

Download our Planned Giving Notification Form to inform us of your gift plans for Taproot Theatre.

IRA Charitable Rollover

Are you 70 ½ or older? The Protecting Americans from Tax Hikes (PATH) Act of 2015 (known popularly as the IRA Charitable Rollover) allows you to transfer up to $100,000 each year to charity without it being treated as a taxable distribution. Here are the requirements and restrictions for making an IRA charitable rollover gift:

- The donor must be 70 ½ or older.

- The gift must be made directly from the IRA to an eligible charitable organization.

- Gifts to all charities combined cannot exceed a total of $100,000 per taxpayer for the year.

- The gifts must be outright, and no material benefits can be received in return for the gifts. Thus a transfer of gift annuity, charitable remainder trust or pooled income fund is not permitted.

- Gifts cannot be made to a donor advised fund, supporting organization or private foundation.

- The gift is not included in taxable income, and no charitable deduction is allowed.

- The gift can only be made from an IRA. Gifts from 401(k), 403(b) and 457 plans are not permitted.

Please note: The information on this page is designed only to provide information on gift options. Always talk to a tax or legal advisor before making a decision on legacy giving.

If you have further questions or would like more information about Planned Giving options, please contact us at development@taproottheatre.org.

Taproot Theatre is a 501 (c) (3) charitable organization, Federal Tax ID# 91-0971237. Your donation to Taproot Theatre Company is tax-deductible to the fullest extent of the law.

Thank you.

Your investment in Taproot Theatre creates theatre experiences that brighten the spirit, engage the mind and deepen the understanding of the world around us. Thank you for making hope-filled theatre possible.